Climate bonds are fixed-income financial instruments linked to climate change solutions. They aim to provide financing for climate change solutions, such as mitigation or adaptation projects. These might be greenhouse gas emission reduction projects ranging from clean energy to energy efficiency, or climate change adaptation projects ranging from building Nile delta flood defenses to helping the Great Barrier Reef adapt to warming waters.

Like regular bonds, Climate Bonds can be issued by governments, multi-national banks or corporations. The issuing entity guarantees to repay the bond over a certain period, plus either a fixed or variable rate of return.

Most Climate Bonds are use-of-proceeds bonds, where the issuer promises to the investors that all the raised funds will only go to specified climate-related programs or assets, such as renewable energy plants or climate mitigation funding programs.

Some Obviously Use-Of-Proceeds Bond Types:

Project bonds – where the money is in a separate company or special purpose vehicle (SPV) for a particular project.

Asset-backed securities – where the money is for a portfolio of cash flows that are securitized in a single bond, such as a portfolio of loans to renewable energy projects.

Covered bonds – where the investor has dual recourse to the issuer balance sheet (typically a bank) as well as a pool of high-quality assets (usually mortgages too).

Corporate bonds are not generally use-of-proceeds bonds; the company is free to use the funds as they see fit. However, use-of-proceeds climate bonds, using the model the European Investment Bank pioneered for their Climate Awareness Bonds, allow companies to issue a corporate bond in terms of creditworthiness, but to interest thematic investors by agreeing to verifiably invest those funds in climate change related activities.

Examples of Green Bonds (Climate Bonds) from the World

The World Bank is a major issuer of green bonds and has issued $14.4 billion of green bonds since 2008. These funds have been used to support 111 projects around the world, largely in renewable energy and efficiency (33%), clean transportation (27%), and agriculture and land use (15%).

One of the bank’s first green issuances financed the Rampur Hydropower Project, which aimed to provide low-carbon hydroelectric power to northern India’s electricity grid. Financed by issuances of green bonds, it produces nearly two megawatts per year, preventing 1.4 million tons of carbon emissions.

The Standards Board will issue a Climate Bond Certificate to an issuer of Climate Bonds when the report of a Verifier confirms that the proposed issue complies with the Climate Bond Standard. The issuer can then hold and use the Climate Bond Certificate and Mark until the Bond term is complete —if the issue continues to comply with the Standard.

An organisation must stop using the Climate Bond Certification Mark if:

- It voluntarily identifies that it is no longer compliant; or

- An independent verification audit commissioned by the Climate Bond Standards Board finds that the bond is no longer compliant

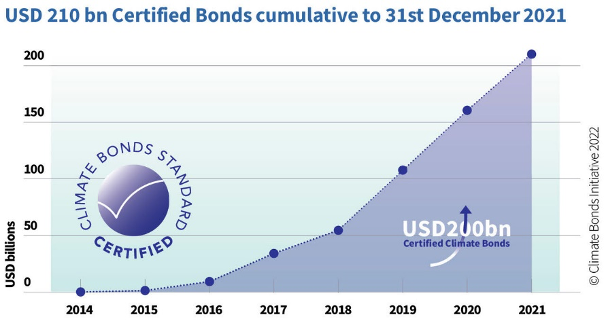

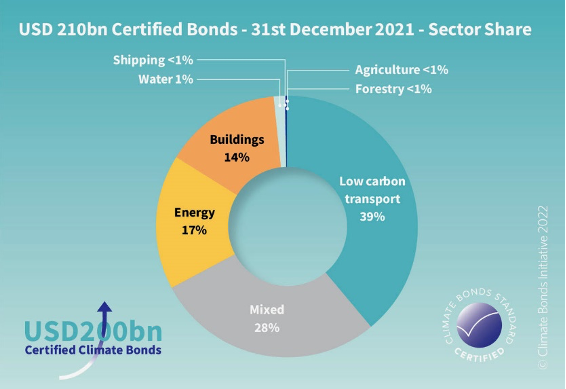

Highlights From 2021

2021 saw a total of USD 53.9bn in Certifications awarded under the Climate Bonds Standard. French rail operator Société du Grand Paris (SGP) was the single largest Certified Bond Issuer in 2021 with USD 7.62bn in Certified green issuance and is the largest cumulative Certified issuer with USD 24.98bn in multiple bonds.

Garanti BBVA

In late 2019, Garanti BBVA issued a 5-year $50 million green bond and used the proceeds to engage in climate action by funding renewable energy projects.

As one of Turkey’s leading renewable energy projects –especially wind power– finance providers, Garanti BBVA contributes to local and global sustainable development energy. The bank further demonstrates its commitment to responsible, sustainable development with this green bond, the first transaction launched by BBVA’s Turkish unit under the Group’s new Sustainable Bond Program. An international sustainability rating agency has certified that the BBVA program complies with the Green Bond Principles (GBP).

Garanti BBVA is committed to reporting transparently on its green and climate-related finance, and thus fully discloses which projects are funded by its green bonds issued since 2019.

https://www.bourse.lu/documents/pdf-CCDC-CBI_climate_bonds_standard.pdf

https://www.climatebonds.net/resources/understanding