The environment is taking center stage in our lives on both global and national, even local levels day-by-day. From the political arena to the classroom, from the international meetings to our business, even to our dinner table, the fact of climate change is discussed from different perspectives. Like every development in human history, climate change also needs financing, which we call climate finance. Paris Agreement defines climate finance as “finance flows consistent with a pathway towards low greenhouse gas emissions and climate-resilient development”. For a more climate-resilient future, there are two different ways of climate financing development: mitigation finance and adaptation finance.

The recent trends of climate finance indicate that much of the climate finance (approximately 76%) committed to date has gone towards climate change mitigation activities.The smaller share of adaptation finance can be traced back to the fact that results from mitigation investments are more urgent and can be realized now. Adaptation finance, on the other hand, might be beneficial in the future but is not necessarily urgent.

Investing in adaptation is smart economics. In Climate Adaptation Summit 2021 (CAS), adding to the announcements and commitments world leaders already made during the opening session, several instruments were presented and launched to support an increase in finance and investment for adaptation. The importance of creating action is highlighted and several stakeholders upscaled the adaptation efforts such as The 1000 Cities Adapt Now program, Locally Led Adaptation program, Water Adaptation Hub, and Africa Adaptation Acceleration Program.

To reduce vulnerability, strengthen resilience and increase the capacity of the planet, a new Glasgow- Sharm el-Sheikh Work Programme on the Global Goal on Adaptation was agreed on during COP26. To realize adaptation real, 80 countries are now covered by either Adaptation Communications or National Adaptation Plans. Also, climate finance providers made commitments to increase their support for adaptation such as UNFCCC Adaptation Fund (Over $350 million) and Least Developed Countries Fund (Over $600 million.)

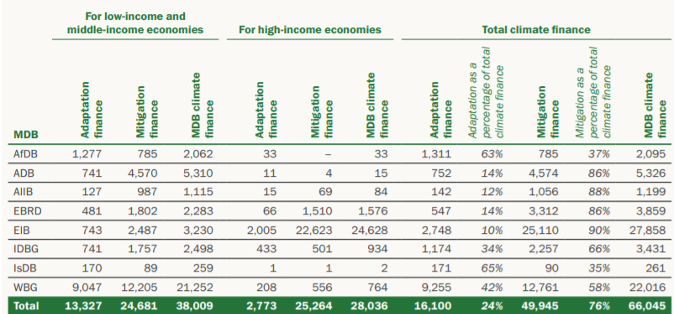

One of the key stakeholders of adaptation finance is financial institutions. International financial institutions, bilateral and multilateral development agencies, and philanthropic organizations have made commitments towards climate change adaptation financing. Multilateral Development Banks (MDBs) are the main sources of climate change adaptation financing as well as the main agencies to implement or execute the financing in their client countries. The total MDB climate finance can be seen in Table 1 below.

Table 1: Total MDP climate finance 2020 (in US$ million)

The Director of Climate of International Institute for Environment and Development, Clare Shakya also highlighted the adaptation finance flows in COP26 by saying “… many wealthier nations are also pledging money to support countries to adapt to climate change, as well as reduce their emissions, is a sign of real progress, tackling both sides of the climate crisis. What’s more, many of those wealthier nations are also agreeing to get finance and decision-making to local communities on the front lines of global warming, supporting them to lead their own response”.

Multilateral Development Banks (MDB). 2020 Joint Report on Multilateral Development Banks’ Climate Finance. 2021.